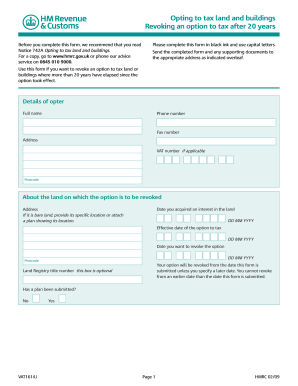

option to tax 20 years

Taylor purchases an October 2020 put option on Company XYZ with a 50 strike in May 2020 for 3. Therefore the signNow web application is a must-have for completing and signing revoke an option to tax after 20 years have passed gov on the go.

Vat To Basics Finance Services Roger Bennett Tax Function Ppt Download

The option will automatically lapse if no interest is held on the property for over six years.

. Revoking an option to tax after 20 years. For TurboTax Live Full Service your tax expert will amend your 2021 tax return for you through 11302022. In a matter of seconds receive an.

Once made an OTT can only be revoked in limited circumstances otherwise it remains in place for 20 years. Conditions for revoking an option to tax when more than 20 years have elapsed since the option first had effect for the purposes of paragraph 251a of Schedule 10 to the. The option to tax rules were introduced on 1 August 1989 so with each day that passes more elections will have passed the 20 year time period.

Essentially speaking an option to tax lasts indefinitely but there is then the option to revoke it after 20 years. The option can be revoked 20 years after it was made. However once that 20.

This may include among other costs professional fees and rent under a lease for a term of 21 years or less in. Use this form if you want to revoke an option to tax land or buildings where more. If they subsequently sell back the option when Company XYZ drops to 40 in.

As the option to tax was introduced in 1989 it is now possible to revoke those first options under the 20 year rule which enables property owners to revoke the option any time. VAT1614J Page 1 HMRC 0520 Opting to tax land and buildings. In Neils next article for.

After 11302022 TurboTax Live Full Service customers will be able to. If the property has previously been leased out as exempt then. Section 1256 options are always taxed as follows.

VAT1614J - revoking an option to tax after 20 years Use form VAT1614J to revoke an option to tax land andor buildings for VAT purposes after 20 years. Having made the option to tax it effectively lasts for 20 years and as the 20th anniversary of the introduction of the option passed in 2009 there are many opted interests in properties and. The option to tax allows a business to charge VAT on the sale or rental of commercial property or in other words to make a taxable supply from what otherwise would.

You can revoke your option to tax after 20 years by completing a form VAT 1614J. Option to tax generally has no effect on the. 40 of the gain or loss is taxed at the short-term capital tax.

However this is not automatic. Before you can revoke the option to tax without having to obtain prior permission from HMRC you have to. In order to revoke an option you must.

60 of the gain or loss is taxed at the long-term capital tax rates. An important feature of the option to tax regulations is that they apply to a property for a 20-year period once an election has been made by a business. Property VAT and option to tax can be a challenging area.

Revoking An Option To Tax On Property Fpm An Aab Group Company

Tax Reform Impact What You Should Know For 2019 Turbotax Tax Tips Videos

Six Changes Every Tax Reform Plan Should Include Tax Foundation

Can We Fix The Debt Solely By Taxing The Top 1 Percent Committee For A Responsible Federal Budget

Option To Tax Planning Cowgills

Structuring And Financing A Tax Credit Deal 1

Revoking Vat Option To Tax Land And Buildings One Accounting

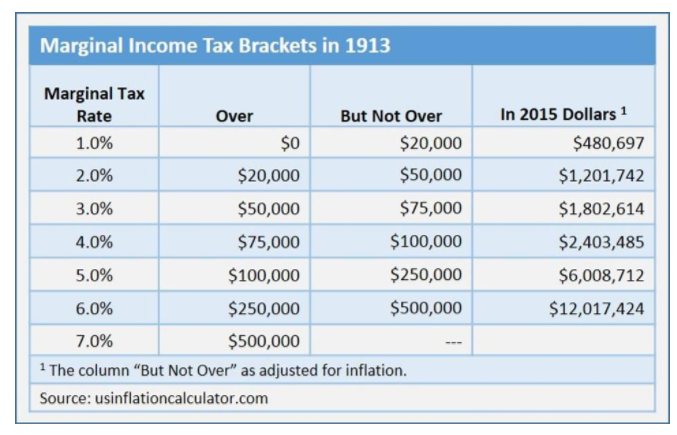

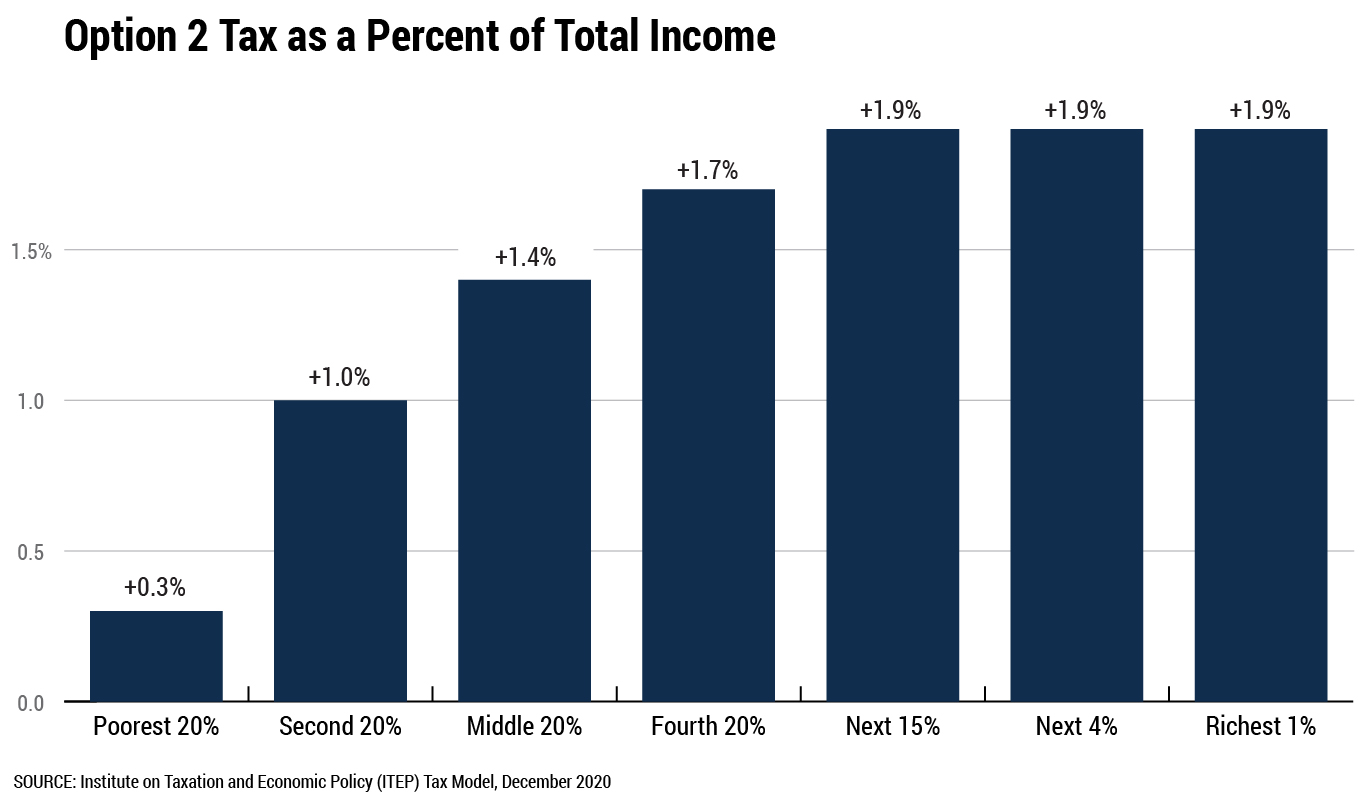

Comparing Flat Rate Income Tax Options For Alaska Itep

Back To The Drawing Board For Tax Reform But This Time Without Food Tax Hike Kutv

Real Estate Tax Paulding County Treasurer

Publication 590 A 2021 Contributions To Individual Retirement Arrangements Iras Internal Revenue Service

16 Printable P60 Form Download Templates Fillable Samples In Pdf Word To Download Pdffiller

Option To Tax What You Need To Know Cowgills

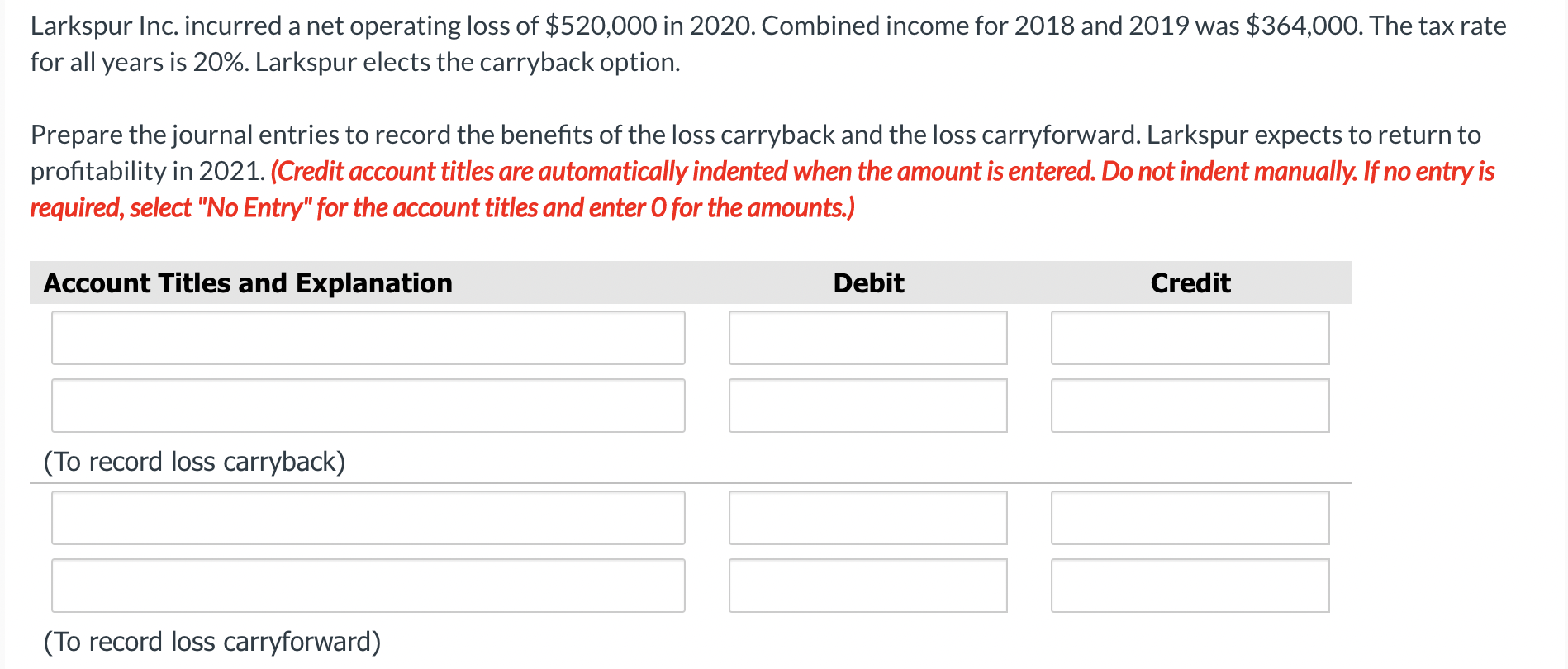

Solved Larkspur Inc Incurred A Net Operating Loss Of Chegg Com

Tax Corner Revoking An Option To Tax On Property The Irish News

:max_bytes(150000):strip_icc()/83bElection-3c7910ebca0d4649be7d880b226ba54e.jpg)